Do you desperately look for 'bond pricing thesis'? Here you can find questions and answers on the topic.

Table of contents

- Bond pricing thesis in 2021

- Bond markets today

- What are government bonds

- What is a bond in stocks

- How bonds work

- Bond pricing thesis 06

- Bond pricing thesis 07

- Bond pricing thesis 08

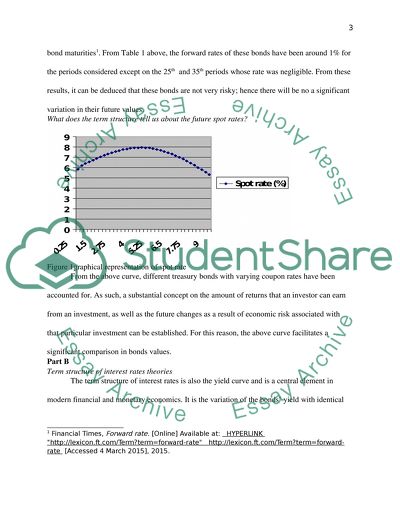

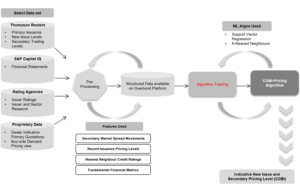

Bond pricing thesis in 2021

This image representes bond pricing thesis.

This image representes bond pricing thesis.

Bond markets today

This image shows Bond markets today.

This image shows Bond markets today.

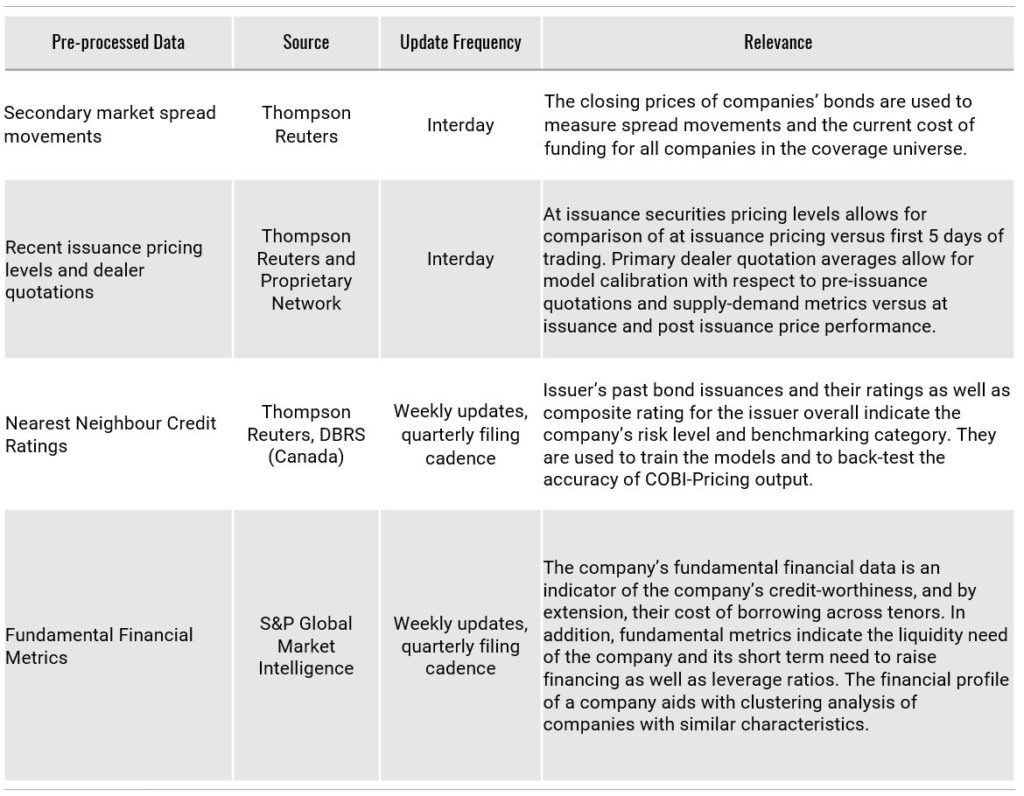

What are government bonds

This image demonstrates What are government bonds.

This image demonstrates What are government bonds.

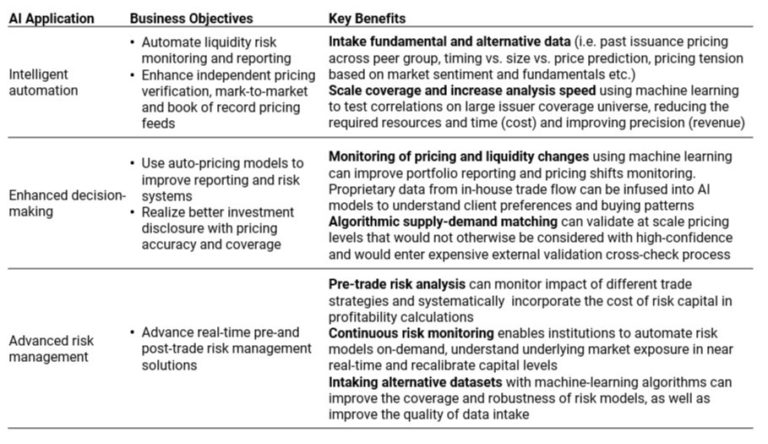

What is a bond in stocks

This image representes What is a bond in stocks.

This image representes What is a bond in stocks.

How bonds work

This picture illustrates How bonds work.

This picture illustrates How bonds work.

Bond pricing thesis 06

This picture shows Bond pricing thesis 06.

This picture shows Bond pricing thesis 06.

Bond pricing thesis 07

This image representes Bond pricing thesis 07.

This image representes Bond pricing thesis 07.

Bond pricing thesis 08

This image demonstrates Bond pricing thesis 08.

This image demonstrates Bond pricing thesis 08.

How is interest paid on a Consol bond?

With a consol, interest is paid forever, but the principal is never repaid. Many bonds contain a provision that enables the issuer to buy the bond back from the bondholder at a pre-specified price before maturity. This price is known as the call price. A bond containing a call provision is said to be callable.

What do you need to know about bonds in MBA?

Bonds form a significant portion of the financial market and are a key source of capital for the corporate world. Therefore every corporate finance course in the MBA program will introduce students to bonds at varying depth.

How is the price of a bond determined?

A bond’s price equals the present value of its expected future cash flows. The rate of interest used to discount the bond’s cash flows is known as the yield to maturity (YTM.) A coupon-bearing bond may be priced with the following formula:

What are the maturities of US Treasury bonds?

U.S. Treasuries can be classified by their maturities as follows: Treasury bills – the maturity is one year or less; the currently available maturities are 4 weeks, 13 weeks, 26 weeks and 52 weeks Treasury notes – the maturity ranges between 1 and 10 years; the currently available maturities are 2, 3, 5, 7 and 10 years

Last Update: Oct 2021